When people ask about how ‘safe’ or how ‘secure’ Bitcoin is, a few different meanings can come to mind. What is Bitcoin?

Can Bitcoin be stolen?

As with almost every other asset, it is possible for Bitcoin to be stolen. However, if you are diligent and store your coins properly, you can make them incredibly secure – far more secure than the average set of credit card details, for example. When you purchase Bitcoin it’s likely that you will be doing it on an exchange. An exchange is like a market where cryptocurrencies are traded between each other or for fiat money (Dollars, Pounds, Euros etc). Although there have been some horror stories about exchanges being hacked, most modern exchanges are secure and safe to use. However, if your Bitcoins are sitting on an exchange then they’re not technically in your possession. You own it, and you’ve paid for it – but an exchange is not a bank. It’s a service designed to transfer cryptocurrency and not a place to store it long term.

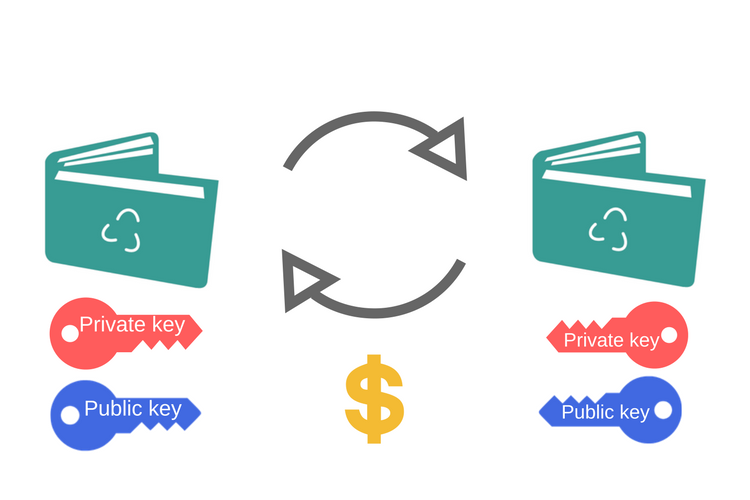

A cryptocurrency wallet is what it sounds like; it’s a place to store your cryptocurrency if you want it to be safe and sound. Most traders will keep a large chunk of their currency on the exchange so they can buy and sell at a moment’s notice, which you can’t do from your wallet – but if you’re just looking to buy and hold as an investment then you’ll want to store more safely. Cryptocurrencies differs from fiat in that you do not trust a bank to hold your currency for you, you use the infrastructure of the blockchain to hold it yourself in a personal wallet. There are various different types of wallet ranging from ones you can use online, to ones located on a USB stick or drive, all the way through to a ‘paper’ wallet – where there is no record of the wallet on a digital device at all, instead you print out a string of numbers and letters onto a piece of paper and store it somewhere safe. If you lose the information of your wallet though there is no one there to help you get it back. Your currency is entrusted to your hands alone, so make sure you do some reading before setting a wallet up.

Is Bitcoin in a bubble?

If I had been writing this article at the start of January, I would have said yes without hesitation. Now writing this on 8 February after the market cap for cryptocurrencies dropped from just over $819 billion to $282 Billion over the past month, and then recovered by $100 Billion over the course of 24 hours, I’m still tempted to say yes – but it’s too early to even speculate, as the dust has barely settled.

Much of the money in cryptocurrencies is speculative investing at best, as there are currencies with market caps of tens or hundreds of millions of dollars that don’t even have working products yet. People are investing in what a project could be, and not what it is at the moment, which is about as close to classic bubble behaviour as you can get. That doesn’t necessarily mean that a bubble is a bad thing. It shows a lot of faith in the the coins and technology behind them, but it does mean that potential investors need to be extremely aware of what they’re getting into.

How secure is Bitcoin to invest in?

The cryptocurrency space is still very new and the technology behind it has a lot of people very excited. Assuming that all goes well, and this technology starts to be widely adopted across the globe, the value of legitimate crypto projects could explode. Unlike some newer projects, Bitcoin doesn’t have a use outside of a currency. It’s designed as a way to transfer money instantly from person to person, safely. There is new technology coming that threatens to do this faster and cheaper, but Bitcoin’s lightning network is set to launch this year which should help it to compete. What Bitcoin does have, is a household name. It’s the only cryptocurrency that the vast majority of people have heard of, and the benefit that brings can’t be overstated. However, there is no denying that Bitcoin is also one of the most volatile assets currently available to trade. The price over the past month has been as high as $16,000 and as low as $6,000, so this is not an investment area for the faint of heart. Some of the old investment rules apply here, if you’re thinking about stepping into this space. Never invest more than you can afford to lose, and always do your own research before investing your hard earned money into anything. If you’re looking at this for a longer term investment, then appreciate that after you purchase an asset, you only gain/lose money when you sell that asset again. The market may go up, down, sideways or in circles – but none of your gains or losses are set in stone until you sell. No one can say for sure what is going to happen to Bitcoin over the next few years, but in my opinion, the blockchain technology that is behind cryptocurrencies is certainly not going anywhere. It doesn’t look like something that’s going to fade away, and if we do start to see adoption on a larger scale, then the sky really is the limit.